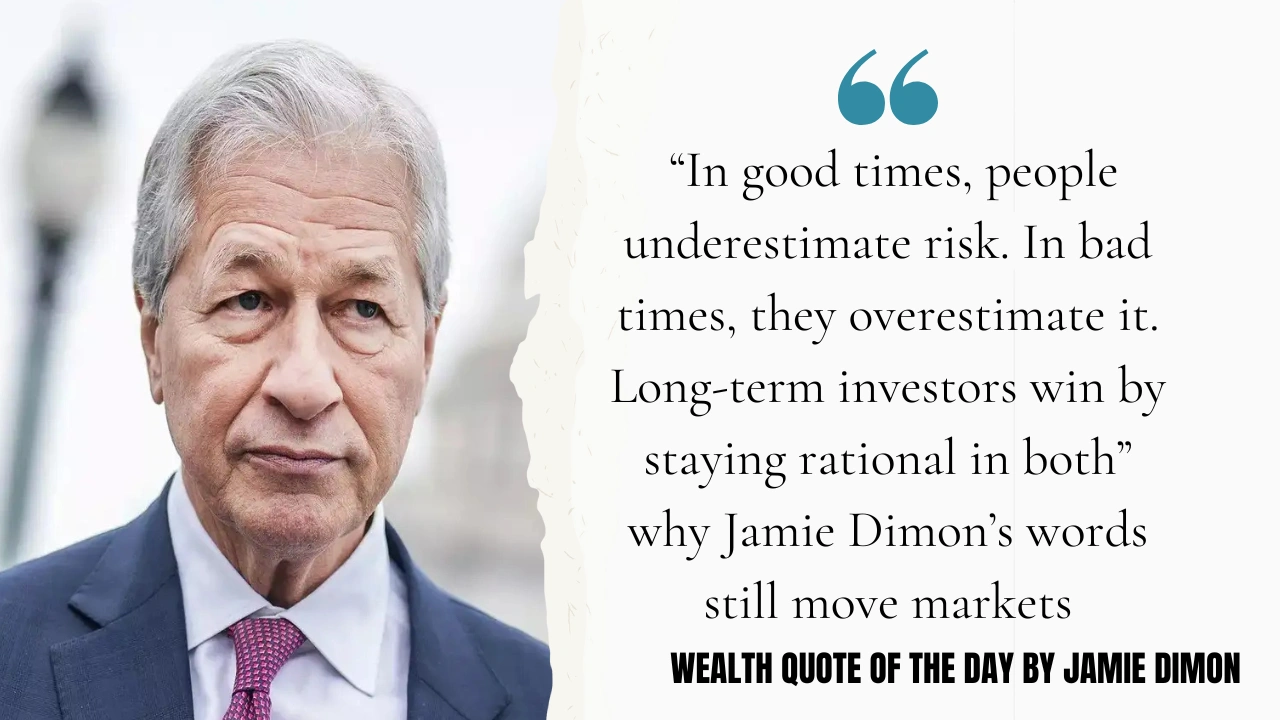

Markets often move on emotion, but history shows that discipline and clear thinking separate long term winners from short term speculators. The Jamie Dimon Wealth Quote captures this idea perfectly. It explains how investors tend to ignore risk when markets rise and exaggerate fear when markets fall. The Jamie Dimon Wealth Quote is not just a motivational line. It reflects decades of real financial leadership and decision making that shaped one of the most powerful banks in the world.

Jamie Dimon’s philosophy continues to influence global markets because it is grounded in data, experience, and disciplined strategy. From the 2008 financial crisis to modern AI driven banking, his approach shows how rational thinking, balanced risk management, and long term focus help investors survive volatility and grow wealth across economic cycles.

Jamie Dimon Wealth Quote

The Jamie Dimon Wealth Quote highlights a timeless investment truth that markets are driven by psychology as much as fundamentals. During bull markets, investors often assume risk has disappeared. During downturns, fear dominates and many exit at the worst time. Dimon argues that long term success belongs to those who remain rational in both extremes. His leadership at JPMorgan shows how disciplined risk management, strong balance sheets, and long horizon investing can outperform emotional decision making. The Jamie Dimon Wealth Quote also reflects modern investment strategy where data, diversification, and patience matter more than speculation. Investors who focus on fundamentals instead of headlines often benefit the most over time.

Overview Table

| Key Insight | Details |

| Quote Message | Stay rational in both good and bad markets |

| CEO Since | Jamie Dimon became CEO in 2005 |

| JPMorgan Market Value | Grew from about 130 billion to over 500 billion at peak |

| Assets Managed | Over 4 trillion globally |

| Net Worth | Around 2.9 billion in 2026 |

| Stock Performance | JPMorgan stock up over 160 percent since 2006 |

| Crisis Leadership | Strong performance during 2008 financial crisis |

| Technology Investment | Billions invested annually in AI and innovation |

| Risk Strategy | Focus on disciplined and data driven decisions |

| Investor Lesson | Long term rational investors outperform emotional traders |

The data behind the man: Jamie Dimon’s track record and wealth build up

The story behind the Jamie Dimon Wealth Quote becomes clearer when examining his track record. Since becoming CEO of JPMorgan, Dimon has guided the bank through major financial cycles while steadily growing shareholder value. The bank expanded into the largest financial institution in the United States with more than 4 trillion in global assets.

JPMorgan’s stock has climbed more than 160 percent since 2006, reflecting consistent profitability and disciplined leadership. Dimon’s personal net worth of about 2.9 billion is largely tied to JPMorgan shares, showing alignment with long term performance. His compensation is performance linked, reinforcing the principle that sustainable growth matters more than short term gains.

The Jamie Dimon Wealth Quote is not theoretical. It is supported by measurable outcomes built over two decades of financial leadership and strategic decision making.

Risk through cycles: Data led decisions define Dimon’s philosophy

One of the strongest examples behind the Jamie Dimon Wealth Quote is his approach to risk management across economic cycles. Before the 2008 financial crisis, JPMorgan reduced around 12 billion in subprime mortgage exposure. This move protected capital and allowed the bank to expand during market distress by acquiring major institutions at discounted valuations.

Even during setbacks like the London Whale trading loss, Dimon responded with transparency and stronger risk controls. His belief remains consistent that disciplined correction and data driven decisions matter more than denial.

The Jamie Dimon Wealth Quote reflects this mindset that risk never disappears in good times and never becomes uncontrollable in bad times when managed with discipline.

Why rational thinking matters: Insights for long term investors

The Jamie Dimon Wealth Quote resonates strongly with investors because it addresses two common behavioral mistakes.

Good times: Underestimating risk

During market booms, investors often believe growth will continue endlessly. Valuations rise, volatility falls, and risk appears low. Dimon warns that such optimism can hide underlying dangers. Rational investors remain focused on diversification, strong fundamentals, and realistic valuations.

Bad times: Overestimating risk

Market downturns often create panic selling. Many investors exit when prices fall, missing recovery phases. Historical data shows that markets frequently rebound when fundamentals stabilize. Staying invested and rational often produces better long term returns.

The Jamie Dimon Wealth Quote teaches that emotional extremes destroy wealth while disciplined thinking protects it.

Strategic investments shaping the future: Innovation, AI, and resilience

Dimon’s strategy is not only about avoiding risk but also about investing in future growth. JPMorgan continues to invest heavily in technology, artificial intelligence, and digital infrastructure. In 2026, the bank allocated nearly 18 billion toward technology and innovation.

These investments improve efficiency, strengthen risk monitoring, and enhance customer experience. Dimon believes that failure to invest in digital transformation could leave financial institutions behind. The Jamie Dimon Wealth Quote aligns with this forward looking approach where rational decision making includes both risk control and innovation.

Long term investors often succeed because they focus on sustainable growth sectors such as technology, AI, and data driven finance rather than short term speculation.

FAQs

1. What does the Jamie Dimon Wealth Quote mean for investors

The quote teaches that investors should stay rational in both rising and falling markets. Emotional decisions often lead to losses while disciplined long term investing improves returns.

2. How successful has JPMorgan been under Jamie Dimon

Since 2006, JPMorgan stock has risen more than 160 percent and the bank now manages over 4 trillion in global assets. Strong crisis management and innovation investments drove this growth.

3. What is Jamie Dimon’s net worth in 2026

His net worth is estimated at around 2.9 billion, mostly tied to long term ownership of JPMorgan shares and performance based incentives.

4. How does Jamie Dimon manage investment risk

He focuses on strong balance sheets, liquidity, disciplined capital allocation, and data driven decisions. This approach helped JPMorgan navigate financial crises successfully.

5. Why does Jamie Dimon invest heavily in AI and technology

He believes future financial leadership depends on digital innovation, automation, and advanced analytics. Continuous investment strengthens competitiveness and long term growth.